By Kaden LeFevre

Picture this: a country club with a beautiful golf course, located just outside of town. You see flowers, bouquets, suits, dresses, a balloon arch, and, amid it all, two people standing near an altar, promising loyalty and fidelity “as long as [they] both shall live.” In an ideal world, that couple will read their vows, say their “I do’s”, and run off to spend the rest of their lives together.

I would doubt—unless you are a sociologist or an economist—that during a touching moment such as this, you would think to ask yourself – “hmm, I wonder how this couple’s marriage will influence their career trajectories and the rate at which they will accumulate wealth relative to their non-married peers?” Obviously, this question sounds odd in this context, but wouldn’t you agree that a decision like marriage deserves some due examination?

Marriage is a topic that is talked about too much in some circles and perhaps not enough in others. It occupies the mind of some young adults, is merely an afterthought for many bachelors, finds itself at the heart of political debates, and remains a fleeting wish for some who have reached the more tender ages of life without it.

Marriage has decreased in popularity over the past decade, yet it seems to be an eventual wish for most young people. Having several close friends who have recently tied the knot, and with life pushing me closer to deciding when and if I personally want to get married, I thought I’d dive in a bit and see what published research has to say about how the decision to get married influences one’s career trajectory, income, and accumulation of wealth.

Impact on Career Trajectory

The course of one’s professional career can take many twists and turns. Take my father for example: his professional career began after graduating from Brigham Young University. He was hired as a financial analyst for Ford Motor Co. in Detroit, and after finishing his MBA at Michigan State, he was headhunted by a pharmaceutical company in Minnesota. After moving his family with four kids all under the age of 8 to Minneapolis, his company downsized, and he was laid off. With a wife and several hungry mouths to feed, my father nervously decided to venture into real estate, where he has been buying, flipping, and selling homes for the better part of 20 years. When I asked him a few years back what exactly motivated him to go into real estate, he answered: “I had to find a way to put food on the table, and I wanted to have time to spend with my family rather than being in the office all day.”

For my father, his marriage and his family were the primary factors that guided his career path. However, he is not the only person I know whose careers have taken unexpected turns and whose decisions have been guided by doing what was best for their marriage or family. With his experience in mind, I pose the question: “how does marriage generally impact career trajectory?”

In short, the research confirms that marriage greatly influences career trajectory. As far back as 1999, a study by Harvard sociologist Elizabeth W. Gorman found that married individuals are much less likely to leave a current job prior to lining up a new one. Those who are married also tend to spend a longer period working at a single company, leading to tenure and position advancement.[1]

Meanwhile, a study by the American Historical Association concluded that both married men and married women who have children are generally seen as more trustworthy by employers, yet men with children are promoted with higher frequency and see their wages increase more rapidly than do women who have children.[2]

So, when it comes to career trajectory, those who have found a spouse stick around longer and make smarter job-transfer decisions, while men with children are able to climb the position ladder fastest.

Impact on Income

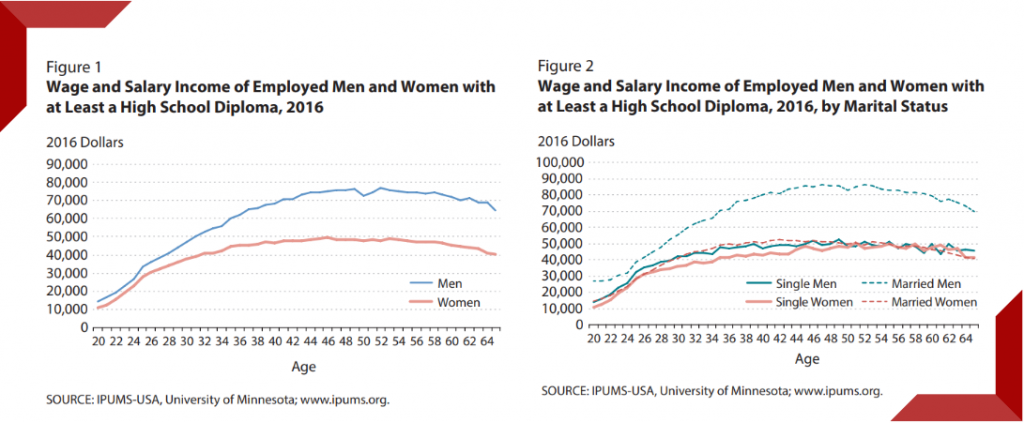

While many still debate the reality of the widely reported wage gap between men and women, a 2018 study by the University of Minnesota confirmed that men on average make significantly more money than women (see Figure 1), while married men with at least a high school diploma earn significantly more money when compared to married women, non-married women, and non-married men.[3]

On average, young married men, aged 28-30, make $15,900 more than their single male peers, and married men aged 44-46 make $18,800 more than their single peers.[4] Approximately half of this gap can be attributed to the fact that married men tend to work longer hours, with one study estimating that married men spend on average 400 additional hours working per year over other groups.[5] It is evident that marriage, therefore, plays a very positive role on how much a husband makes.

For women, the data and studies are far less conclusive. Many believe that married women are at a disadvantage in the workplace due to the additional demands of raising children and caring for at-home affairs.

This belief is supported by many sociologists; for example, Michelle Budig, a sociology professor at the University of Massachusetts, Amherst, concluded that women experience an average wage decrease of 4% for every child they have, while children have an opposite effect on men’s income, with each child bringing on average a 6% increase in income.[6]

These results cause many women to delay marriage or choose to forego marriage altogether in pursuit of a career, and while being among the loudest competing voices, they are not the only one.

According to the same University of Minnesota study, married women actually earn slightly more than non-married women across all age groups, with married women just barely beating out single men and women between ages 33-45.

Overall, the various studies on wages of working women don’t fully agree with each other – with some favorably displaying the prospect of marriage and a career, while others hastily conclude that the two are incompatible with one another.

Impact on Wealth

A large factor in the accumulation of wealth is how much of one’s income they spend each year. Simple logic can be used to conclude that someone who spends 90 cents of every dollar they bring home is going to have less money left over than someone who only spends 70 cents per dollar.

Information published by the U.S. Bureau of Labor Statistics shows just how much being married influences spending habits. According to data from 2018, couples spend on average 6.9% of their annual income on their health, compared to single men who spend only 3.9% and single women who spend 7.9%. Married couples spend on average 23.9% of their annual income on housing, while single men spend 30.3% and single women spend 39.8%. Less notably, married couples without children tend to spend slightly less (~.5%) on transportation, food, apparel, and subscription services than their single counterparts, while couples with children spend slightly more than singles (~.5%) within these respective categories.[7]

While spending a lower percentage of your money is great, any financial planner knows that decreasing expenses is only half the battle when it comes to accumulating wealth. The other major factor is what you do with the leftover money. In addition to spending less, married couples, as researchers concluded in a 2007 study, tend to save more money as well as put more money into long-term investment accounts such as IRAs and 401(k) plans.[8] That is not to say that being married makes one immune to poor money decisions, but it generally holds true that couples who choose to make all significant financial decisions together tend to do better at saving for a rainy day and accumulating long-term wealth than single individuals.

Is Marriage a Worthy Investment?

No one can promise that marriage will benefit all people in

the same ways. Men are more likely to be promoted in their companies if they

are married, but this trend comes with no guarantee. Women who are married will

spend nearly half as much of their annual income on housing. Nearly all studies

from the past 20 years indicate that men who want to earn more will typically

benefit from settling down, committing to a long-lasting marriage, and having a

couple children; meanwhile, if women make those same decisions, they may not

see their labors adequately reflected in their paychecks. In general, couples

accumulate wealth better and spend less of their money, but the reality of that

statement for a real-life couple depends largely on their planning and

priorities. Ultimately, marriage is both a risk and an investment, and one

should consider all possible outcomes when making their decision if, when, and

perhaps most importantly, to whom they choose to marry.

[1] Gorman, Elizabeth H. “Bringing Home the Bacon: Marital Allocation of Income-Earning Responsibility, Job Shifts, and Men’s Wages.” Journal of Marriage and Family 61, no. 1 (1999): 110-22. doi:10.2307/353887

[2] Townsend, Robert B. “Gender and Success in Academia: More from the Historians’ Career Paths Survey.” Perspectives on History 51, no. 1 (January 1, 2013).

[3] Guillaume Vandenbroucke, “Married Men Sit Atop the Wage Ladder,” Economic Synopses, No. 24, 2018. https://doi.org/10.20955/es.2018.24

[4] Townsend, Robert B. “Gender and Success in Academia: More from the Historians’ Career Paths Survey.”

[5] Lerman, Robert I., Joseph P. Price and W. Bradford Wilcox. “Family Structure and Economic Success across the Life Course.” Marriage and Family Review 53,8 (2017): 744-758.

[6] “Consumer Expenditures–2018.” Bureau of Labor Statistics, September 10, 2019. https://www.bls.gov/news.release/cesan.nr0.htm.

[7] Ibid.

[8] Lyons, Angela & Neelakantan, Urvi & Fava, Ana & Scherpf, Erik. (2007). For Better or Worse: Financial Decision-Making Behavior of Married Couples?. SSRN Electronic Journal. 10.2139/ssrn.985894.